Stocks saw their worst performance last week since the banking crisis in March with a 2.93% decline in the S&P 500 as longer-term Treasury yields rose to new 16-year highs. It was a risk off week with growth underperforming value stocks – consumer discretionary stocks lost 6.35% while consumer staples were down just 1.78%. Meanwhile, the 10-year Treasury note saw selling pressure as its yield rose to a high of 4.51%, the highest since October 2007, and was up 11 basis points on the week, while the shorter-maturity 2-year note’s yield rose to a high of 5.20%.

What was the reasoning for the move? A Fed projecting higher interest rates for longer. Yes, we have heard this many times over the past several months, with remarks from Chairman Powell to comments from many different district presidents. However, we saw it updated in the Fed’s summary of economic projections – the quarterly forecast from 19 of the Federal Reserve decision makers on things such as employment, inflation, economic growth, and interest rates.

The Federal Open Market Committee (FOMC) voted to keep rates unchanged at 5.25%-5.50% as widely expected, while keeping its balance sheet unwinding plans unchanged (selling Treasury securities in the open market). The policy statement was basically unchanged from the July meeting, expect it noted the economy is growing at a “solid” pace, upgraded from a “moderate” pace.

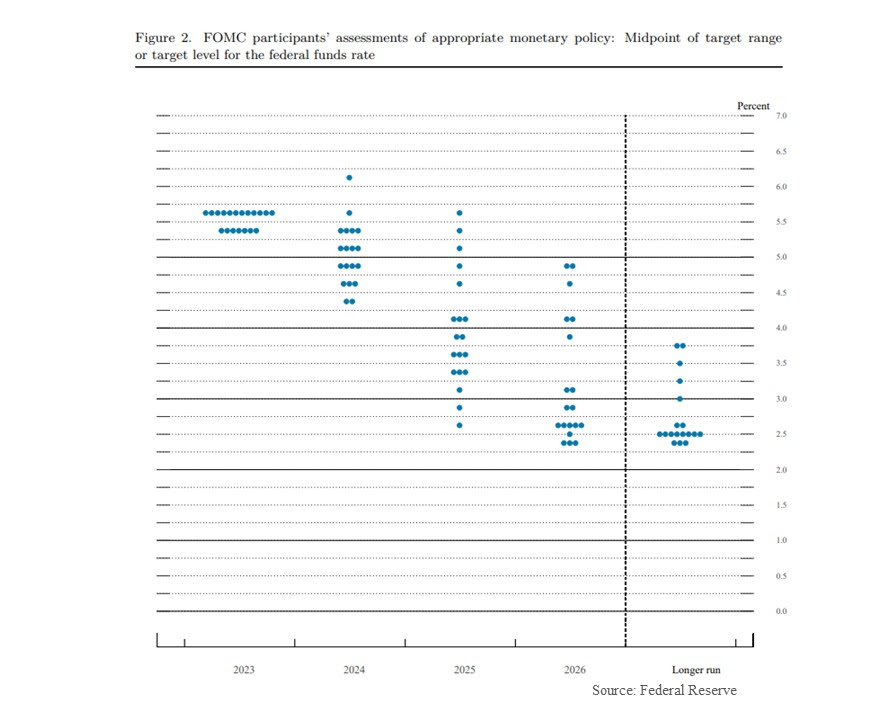

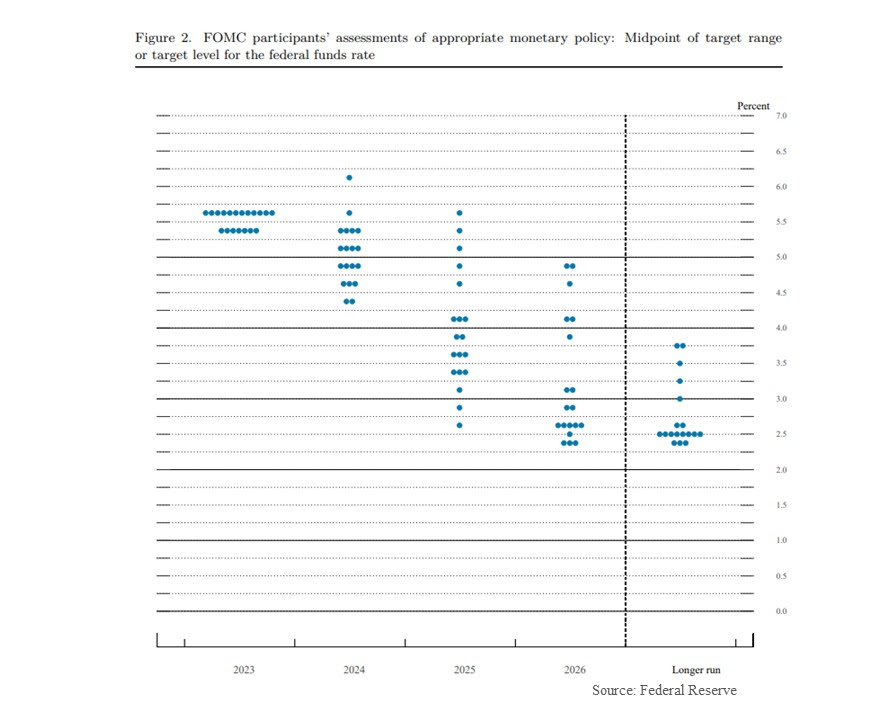

This wasn’t the focus though. We knew going into the meeting all attention would be on the “dot plot.” This is a chart (seen below) on where all 19 policymakers see rates by the end of the current year, along with the next three years, and longer-term.

There remains a bias to raising rates and a bias to keeping rates much higher for much longer, and this is where markets were slightly surprised. The dots show 12 of the 19 policymakers see at least one additional rate hike this year (the street was expecting less). In addition, the interest rate forecasts by policymakers for 2024 and 2025 moved higher than what was expected. The average dot sees rates ending 2024 at 5.1%, up from 4.6% in the June projections, indicating just two rate cuts next year. The end of 2025 rate projections were 3.9%, up from 3.4% in June, indicating just 1.75% or seven rate cuts over the next two years.

At the same time, projections on inflation were relatively unchanged while projections on economic growth moved higher. Projections on economic growth in 2023 was nearly doubled while 2024 was +1.5%, up from 1.1%. Meanwhile, unemployment projections moved lower (2024 projections at 4.1%, down from 4.5%). It was interesting to see stronger growth, stronger labor market, but unchanged inflation and also see rate projections move higher by 50 basis points. This was a question in the press conference to which Chairman Powell said because of stronger economic activity, participants chose to raise rate forecasts.

The Fed appears to believe, and based on market reaction, that the neutral rate is higher than previously thought because the economy has been able to absorb and handle higher rates better than believed. As Powell said “this is part of the explanation on why the economy has been more resilient than expected” and “it is certainly plausible that the neutral rate is higher.” This explains the move higher in longer term Treasury yields. The neutral rate is a theoretical interest rate that is neither accommodative or restrictive, that is it neither supports or restricts/slows economic activity.

Of course, the projections are not preset policy, they are where Fed members forecast things given today’s information. Powell indicated they still do not know how long rates will stay high but will know when they see it. He reiterated the recent good inflation data that has been observed is encouraging but they still want to see more than three months of data to be convinced it is moving back to its 2% target.

We are in a seasonally weak part of the year so the recent 6% pullback in stocks was not totally unexpected. The Fed will remain data-dependent and this will keep increased focus on the upcoming data. Next on the calendar is the PCE price index on Friday in the personal income and outlays release (which include wage and spending data) which happens to be the Fed’s favorite inflation reading. The consensus estimate sees a stronger 0.5% monthly increase in prices in August, stronger due to higher energy prices, with a 3.9% increase in the core index (excludes food and energy categories) over the past 12 months.

|

|

Week in Review:

On Monday, stocks opened the week relatively unchanged in what was an uneventful day. One of the only headlines was the continued strike of the United Auto Workers where no progress was made over the weekend on a new labor contract. In addition, discussions around a potential government shutdown were rising with a key deadline approaching. Data included homebuilder confidence falling in negative territory to the lowest level since April.

Crude oil continued to trek higher in the beginning of the week with a 2.5%

increase early in the day on Tuesday (however giving up gains and falling slightly for the day) further complicating the inflation picture with many strategists increasing their oil price forecasts. It was an uneventful day again, with data in the morning showing a slight increase in housing starts from August. Treasury yields saw an uptick with the 10-year yield 4 basis points higher to 4.36%, over higher oil and an uptick in inflation in Canada, while stocks fell 0.2%, near the highest levels of the day.

The main event for the week was Wednesday with the FOMC meeting and Chairman Powell’s press conference. The policy decision was as expected, no change in rates or its balance sheet reduction plans, but there was an upward shift on future interest rates in the projections, with policymakers seeing less rate cuts in 2024 and 2025 amid stronger economic growth and lower unemployment. This slightly more hawkish stance resulted in the markets believing the Fed’s “higher for longer” stance and Treasury yields moved higher as stocks moved lower, finishing the day down 0.94%.

Investors took more time to digest the FOMC meeting and projections and came into Thursday trading in selling mode for both stocks and fixed income, following global markets lower. Data on jobless claims moved back to the lows of the year, and near 50-year lows, reflecting the tight labor market, while the pace of existing home sales were relatively unchanged in August compared to July. It was a big risk off day with US stock indices finishing at least 1% lower across the board and the S&P 500 seeing its worst day since March.

It was a quieter session on Friday, with investors still digesting the recent FOMC meeting and additional talks on the United Auto Workers strike after it still could not come to a contract agreement with the automakers. Fed speak picked back up with three policymakers saying inflation has not yet shown substantial improvement, further tightening could still be appropriate, and additional talk about the uncertainty on holding rates or doing more tightening. Treasuries saw some upside as yields gave up some of Thursday’s increases while stocks fell 0.23%.

It was a risk-off week with value outperforming growth again and the worst week since March for US stocks as Treasury yields spiked to new 16 year highs. The dollar was higher on tighter Fed policy expectations, gold was slightly lower, and oil snapped a three week winning streak with a 0.8% decline. The 2-year Treasury rose 6 basis points to 5.10% and 10 year Treasury rose to a new 16 year high of 4.51% before finishing the week at 4.44%, up 11 bps on the week. The four major US stock indices finished as follows: Dow -1.89%, S&P 500 -2.93%, NASDAQ -3.62%, and Russell 2000 -3.82%.

|

|

Did You Know…?

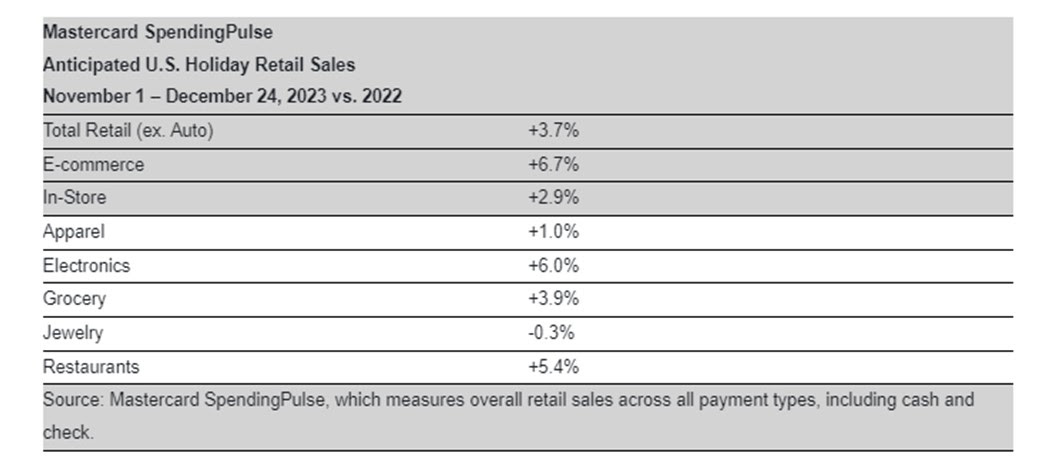

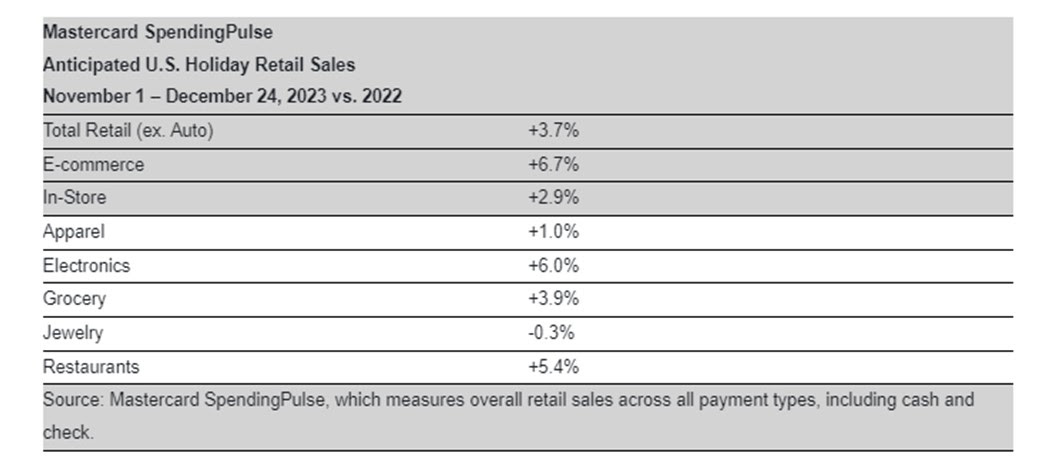

Holidays Sales Forcasts:

Mastercard SpendingPulse estimates that US retail holiday sales (the period from November 1 to December 24) will increase 3.7% this holiday shopping period. With a 3.7% rate of inflation over the past 12 months, that would put real (inflation adjusted) sales growth of 0%. E-commerce sales are expected to increase 6.7% while in store sales are expected to increase 2.9%. Due to the new technology in AI, as well as consumers looking to upgrade gadgets to the latest model after the pandemic surge, it expects sales of electronics to see strong growth of 6.0%.

WFG News

The Election & Its Impact on The Markets

Wentz Financial Group is happy to announce we will be brining back guest speaker Phil Orlando for a discussion on his and Federated’s thoughts on the current market and economic environment. Phil will expand on the election of 2024 and its implications for markets. Phil Orlando is Chief Equity Market Strategist of Federated Investors with over 43 years of experience and is responsible for formulating Federated’s views on the economy, markets, and the firm’s investment positioning strategies. RSVP early as this event will reach capacity quickly!

Tuesday, October 3 @ 6:00 pm

Wednesday, October 4 @ 12:00 pm