New year, new record. It took almost exactly 24 months for the most followed U.S. stock index, the S&P 500, to reach a new record high. That happen Friday when the index closed at 4,839.81, almost 1% higher than the previous record set January 3, 2022. However, it may not feel like the markets just reached a record high. That is because, as was the case for almost all of 2023, stocks are seeing limited participation – the top, megacap names are driving a majority of the performance to start the year. The average stock fell last week, with the equally weighted S&P 500 down 1.25% while the cap weighted index rose 1.50%.

We were beginning to see some momentum in December with the average stock performing well and broad participation in the market’s rally from the October’s low. However, that seems to have faded through the first three weeks of the year. We think so for several reasons – caution over earnings, a small adjustment to rate cut expectations, and continued strength in mega cap stocks.

First, the strength in mega cap stocks appears to revolve around the continued optimism of artificial intelligence (AI). For example, Nvidia stock has risen 20% since the beginning of the year. The company is the forefront when it comes to AI as it develops the chips that goes into generative learning and most things AI related. Facebook parent company Meta is up over 8% as it was reported to be spending billions on chips for its AI efforts and Taiwan Semiconductor was up last week after saying profits were better than expected thanks to strong AI demand (Taiwan Semi produces the chips). Not to mention Microsoft making new record highs (and now the most valuable public company in the world), and Amazon and Google within reach of their respective highs.

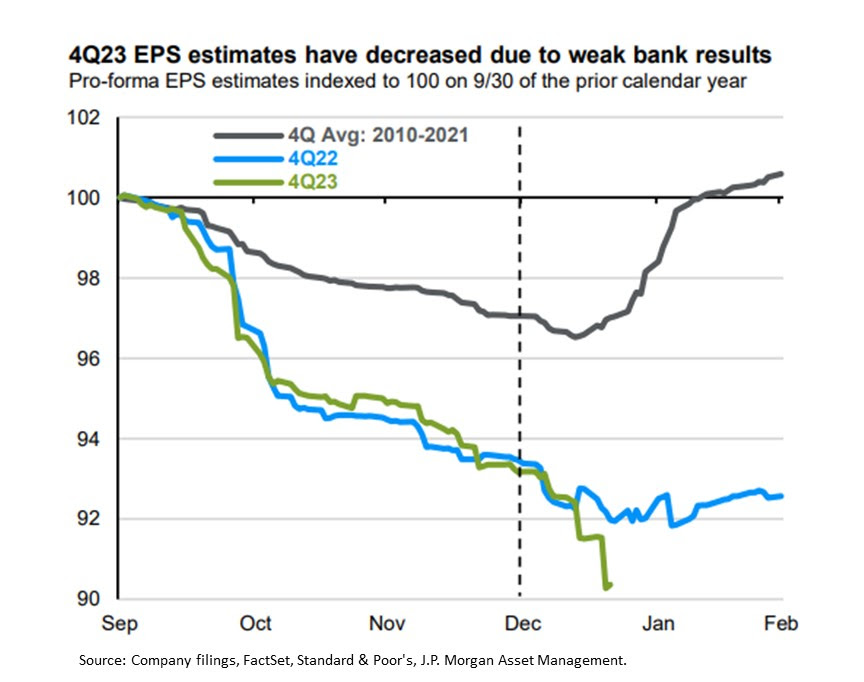

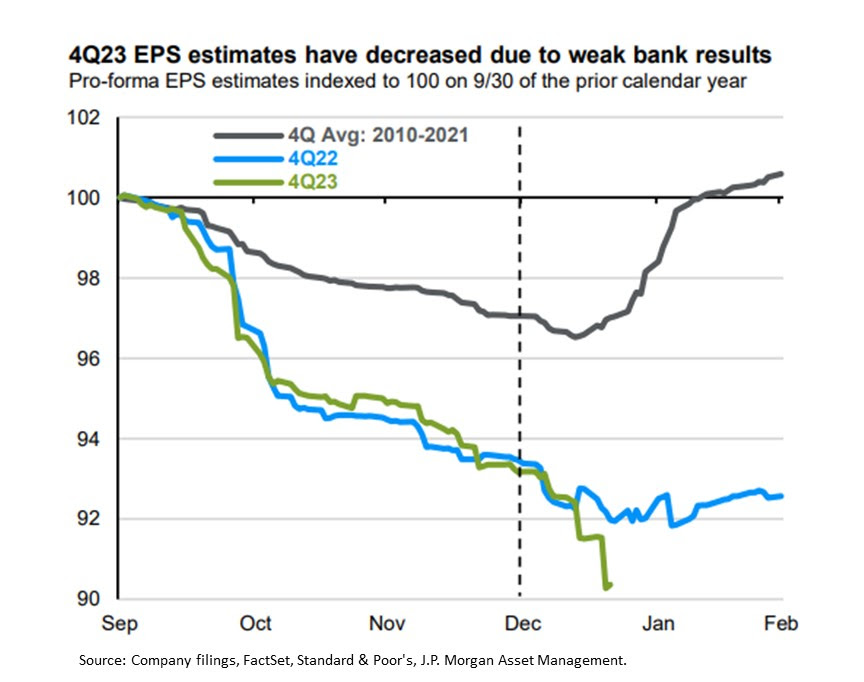

We are only two weeks into earnings season with roughly 10% of the S&P 500 companies having reported results already, although a majority of those have been financials. Earnings season got off to a slow start with estimates coming down slightly. On December 31, fourth quarter earnings in aggregate were expected to increase 1.6%, but as of Friday that expectation has moved lower to a 1.7% decline. Banks were the main reason as their profits were lower than expected, and most forecasted net interest margins (what banks make from interest it charges on loans minus what it pays on consumer deposits) lower than estimates for 2024 due to lower expectations on interest rates. The JPMorgan chart of the week below shows how earnings estimates historically fall heading into a quarter then quickly recover, versus the green line which shows earnings estimates falling much more than typical and, so far, continuing to fall.

Perhaps this biggest effect has been the small reset in market’s rate cut expectations. Coming into the new year, investors were betting the Fed would cut rates about 1.75% by the end of the year, equal to seven rate cuts (25 basis points each), according to interest rate futures pricing by the CME FedWatch Tool. Over the past couple weeks we have heard from a handful of Fed policymakers and the main message is rate cuts are not expected until at least the third quarter, that there is no reason to cut rates as rapidly as in the past, and a warning that if rates are cut too soon, the disinflation progress could stall. The result is Treasury yields (on the 10-year note) have risen back above 4.0% and the markets expectation is around 140 basis points of rate cuts this year (equal to 5-6 cuts) and the expectation for a rate cut in the March meeting dropped to 50%, down from about 80% before last week.

Now, markets have an important two weeks coming up. Almost half the S&P 500 companies are expected to report fourth quarter earnings over this period, including many blue chip, tech, and mega cap companies. Focus will be on 2024 forecasts and thoughts on consumer strength. Economic data will be in focus with the first Q4 GDP estimate and consumer data later this week and additional labor market data next week. Also on the list is central bank meetings. Several large central banks (European Central Bank, Bank of Canada, and Bank of Japan) hold policy meetings this week and the Federal Reserve holds its FOMC meeting next week where all eyes will be on rate cut expectations for 2024.

So, as Tom Barkin, the Federal Reserve President from the Richmond district bank, had said earlier this year – buckle up, even if there is a soft landing.

|

|

Week in Review:

US stocks started the week negative on a day that saw pushback on the market’s aggressive rate cut expectations from both the European Central Bank and the Federal Reserve. Fed Governor Waller said we are in “striking distance” of the inflation target but sees no need to cut rates as rapidly as in the past. Corporate highlights included additional scrutiny of Boeing over its MAX program, more earnings from financials, and a federal judge blocking the acquisition of Spirit Airlines by JetBlue. Stocks were lower across the board with the NASDAQ down 0.19% and S&P 500 losing 0.37% while Treasury yields rose across the curve.

A risk off tone is how the markets started trading Wednesday, coming after a weak day in Asian and European markets. Data was released from China that saw slower economic growth than expected in the fourth quarter and weaker retail sales, while data from Europe showed December inflation came in higher than expected. On the other hand, data from the US showed retail sales were again stronger than expected in December, leading to the thought the consumer and economy is still strong enough that rate cuts are not necessary yet, but the Beige Book said most Fed districts saw little or no change in economic activity over the past 6 weeks. Stocks had another down day as rate cut expectations for March fell. The S&P 500 fell 0.56% while Treasury yields were higher on the short end of the curve.

Events in the Middle East continued to grab attention with airstrikes back and forth between Pakistan and Iran while the U.S. launched its fourth round of airstrikes on Houthi rebels in Yemen. In the U.S., stocks got off to a great start Thursday, driven by tech, more specifically semiconductors, after Taiwan Semiconductor said it expects a better 2024 driven by investment in AI offsetting weakness elsewhere. Upside was limited though from more hawkish Fed commentary from Atlanta’s Bostic that he doesn’t see rate cuts until at least the third quarter. The S&P 500 gained another 0.88% with yields higher.

Friday saw an improvement in consumer sentiment data, helped by inflation expectations moving lower and asset prices moving higher. It was a quieter day with continued focus on Fed commentary and the pushback on aggressive rate cuts. Despite this markets strength continued with the S&P 500 gaining 1.23% and reaching a new record high for the first time in a little over 2 years.

It was a solid week for stock indexes, but market breadth has not been as strong as the equally weighted S&P 500 index underperformed by almost 3% for the week. The Dollar strength continued with the index up 0.9% for the week, gold fell 1.1%, oil was slightly higher with a 0.8% gain, and Bitcoin fell 4% as the excitement over the SEC approval of spot Bitcoin ETFs faded. The Treasury rally reversed with yields higher across the curve – the 2-year rose 24 basis points to 4.38% while the 10-year rose 19 bps to 4.13%. The major U.S. stock indices finished as follows: NASDAQ +2.26%, S&P 500 +1.17%, Dow +0.72%, and Russell 2000 -0.34%.

|

|

WFG News

Economic & Market Outlook Meeting

Thursday, February 1 – 6:00 pm – WFG Auditorium in Hudson, OH

Thursday, February 8 – 12:00 pm – WFG Auditorium in Hudson, OH

Thursday, February 8 – 6:00 pm – WFG Auditorium in Hudson, OH

Wentz Financial Group will be holding its semi-annual Economic and Market Outlook Seminars on the dates above. Join us as we recap a surprisingly positive 2023, explain how we got to where we are today, as well as give our expectation and forecast on the economic and market environment and how that will affect portfolios in another challenging year ahead. We will have three seminar times, one during the lunch hour and the other two in the evening. Please RSVP by responding to this email or by calling the office at 330-650-2700. Seat are limited for each event and will be on a first come first served basis. A buffet style meal will be served approximately 30 minutes before each event.